3 things to know

- Over 15,000 apps delisted from the Google Play Store in H1 2021 had at least 100,000 downloads prior to delisting

- 2,076 apps had at least 1 million downloads prior to delisting

- 5he three most popular delisted apps prior to delisting were developed by Google

In the first half of 2021, Google delisted more than 588,000 apps from Play Store. Overall, they had been downloaded more than 9.3 billion times prior to delisting, and some of them were quite popular. One of the delisted apps even exceeded one billion downloads prior to delisting.

From all delisted Google Play Store apps in the first half of 2021:

- 2,076 were downloaded at least 1 million times

- 162 were downloaded at least 10 million times

- 4 were downloaded at least 100 million times

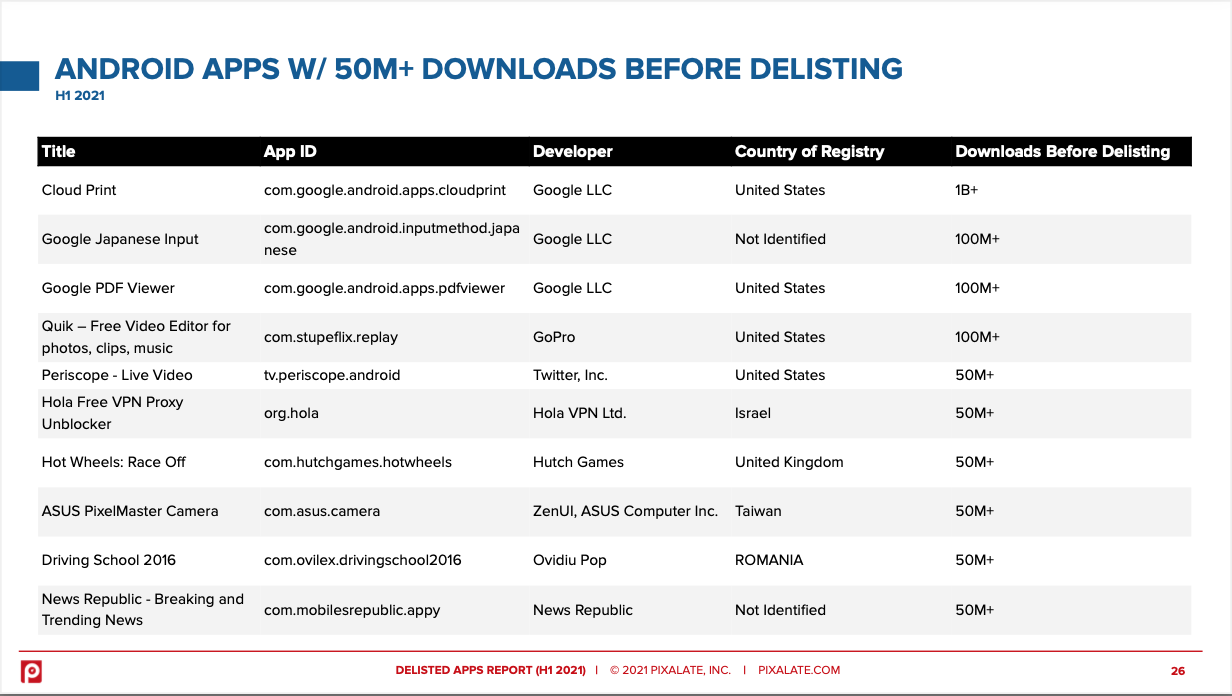

The most popular app delisted in the first half of 2021 was Cloud Print, the only app exceeding one billion downloads. Cloud Print was followed by Google Japanese Input and Google PDF Viewer. Interestingly, all the top three apps were developed by Google LLC. Moreover, two other apps making the top 5 were also produced by well-known and publicly traded companies.

The reasons to delist apps are not necessarily nefarious. For example, the developer can decide that the app does not meet their requirements and wants to improve or replace it with a new app. However, Pixalate identified potential factors that might have influenced Google’s decisions to delist apps, including lack of Terms and Conditions or Privacy Policy.

You can find all potential reasons and much more insights about delisted mobile apps in Pixalate’s report. Download it today here for free!

Disclaimer

Disclaimer

The content of this blog, and the Publisher Trust Indexes (collectively, the “Indexes”), reflect Pixalate’s opinions with respect to factors that Pixalate believes may be useful to the digital media industry. The Indexes examine programmatic advertising activity on mobile apps and Connected TV (CTV) apps (collectively, the “apps”). As cited in the Indexes and referenced in the Indexes’ key findings reproduced herein, the ratings and rankings in the Indexes are based on a number of metrics (e.g., “Brand Safety”) and Pixalate’s opinions regarding the relative performance of each app publisher with respect to the metrics. The data is derived from buy-side, predominantly open auction, programmatic advertising transactions, as measured by Pixalate. The Indexes examine global advertising activity across North America, EMEA, APAC, and LATAM, respectively, as well as programmatic advertising activity within discrete app categories. Any insights shared are grounded in Pixalate’s proprietary technology and analytics, which Pixalate is continuously evaluating and updating. Any references to outside sources in the Indexes and herein should not be construed as endorsements. Pixalate’s opinions are just that, opinions, which means that they are neither facts nor guarantees; and neither this press release nor the Indexes are intended to impugn the standing or reputation of any person, entity or app.