Pixalate builds ad industry’s first vMVPD (Virtual MultiChannel Video Programming Distributor) identification capability and finds vMVPD apps have lower invalid traffic (IVT) rates than other apps.

In this report, we dive deep into vMVPD (Virtual MultiChannel Video Programming Distributor) apps - such as Sling TV and XUMO - to surface programmatic ad insights across Roku and Amazon Fire TV devices.

Key takeaways

- vMVPD apps drove 57% of ad impressions on Roku and 85% on Amazon Fire TV during November 2022

- 71% of Roku ad spend and 62% of Fire TV ad spend was on vMVPD apps

- IVT rates were measured to be higher on non-vMVPD apps:

- 14.9% for non-vMVPD apps vs 11.4% for vMVPD apps on Roku

- 25.7% for non-vMVPD apps vs 8.2% for vMVPD apps on Amazon Fire TV

What are vMVPD Apps?

As the name hints, vMVPD apps aggregate TV channels into a discounted skinny bundle. The term originates from traditional MVPDs like Comcast and Dish TV. vMVPD apps are differentiated from other types of apps, like SVOD (Subscription Video On Demand) and AVOD (Advertising-based Video On Demand) apps, mainly by the fact that those do not “aggregate” channels, but instead curate shows or movies for their users.

This page provides some more details and examples.

Why do vMVPD apps matter to digital advertising?

There are at least three ways vMVPDs behave differently from most other apps.

- As described in our Bundle ID report, they typically are referenced by a higher than average number of Bundle IDs.

- They also tend to have a more complicated inventory sharing arrangement with the various channels they aggregate, which is why the IAB Tech Lab updated app-ads.txt specs to support such apps.

- Finally, advertisers are interested in receiving channel and network information for ad inventory on these kinds of apps.

For all of these reasons, Pixalate has worked on properly identifying these kinds of apps.

Distinguishing vMVPD Apps for the First Time

To properly measure and address this challenge, Pixalate first had to distinguish vMVPD apps from other apps in the CTV app marketplace. Our data science and engineering teams created a methodology to distinguish vMVPD apps and combine it with manual reviews.

This is a first in the programmatic advertising ecosystem. We are making this methodology transparent so the data is understood and can be improved with feedback across the industry.

Methodology:

- vMVPDs are apps that create a “skinny” bundle of channels.

- The term “channels” refers to TV Channels from TV Networks in the traditional sense.

- SVOD/AVOD apps, on the other hand, curate shows and movies and do not focus on the networks the shows are from.

- Netflix for example curates shows and therefore is not an vMVPD. Netflix is a SVOD channel (now AVOD).

- YoutubeTV, SlingTV, FuboTV on the other hand DO focus on channels and are therefore vMVPDs.

- In addition, we also covered a variety of common scenarios / app types

- Apps in which the channels are actually owned by the same parent company but are significant and well-known on their own. We are calling these vMVPDs.

- ▪️ Example: Discovery includes access to TLC, HGTV, Food Network

- Apps in which the channels clearly are from the same company and may have the same name as the app. We are NOT calling these vMVPDs

▪️ Example: ESPN may have ESPN1, ESPN2, etc.

- Apps with curated content, even if they are called “channels,” are NOT vMVPDs

▪️ Example: An automobile focused app with a “Truck Channel,” “Sports car channel,” etc., is not a vMVPD even if they use the term channels.

vMVPD stats

Pixalate analyzed programmatic CTV impressions during November 2022 and found the following:

1. Bundle IDs

According to Pixalate’s data, vMVPD apps have an average of 15 Bundle IDs, compared to 1.5 for non-vMVPD apps. Here’s the breakdown by CTV app store:

- Roku: 13.7 Bundle IDs for vMVPD apps vs. 1.6 for non-vMVPD

- Amazon: 16.6 Bundle IDs for vMVPD apps vs. 1.5 for non-vMVPD

2. Programmatic Ad Impressions

In addition, the top 25 most popular vMVPD apps on Roku and Amazon Fire TV accounted for 57% of programmatic ad impressions on Roku devices and 85% of ad impressions on Amazon Fire TV devices in November 2022.

In a similar vein, Pixalate estimates that 71% of programmatic ad spend on Roku devices and 62% on Amazon Fire TV devices is flowing through these same popular apps, propped up by big names like Hulu and Pluto TV.

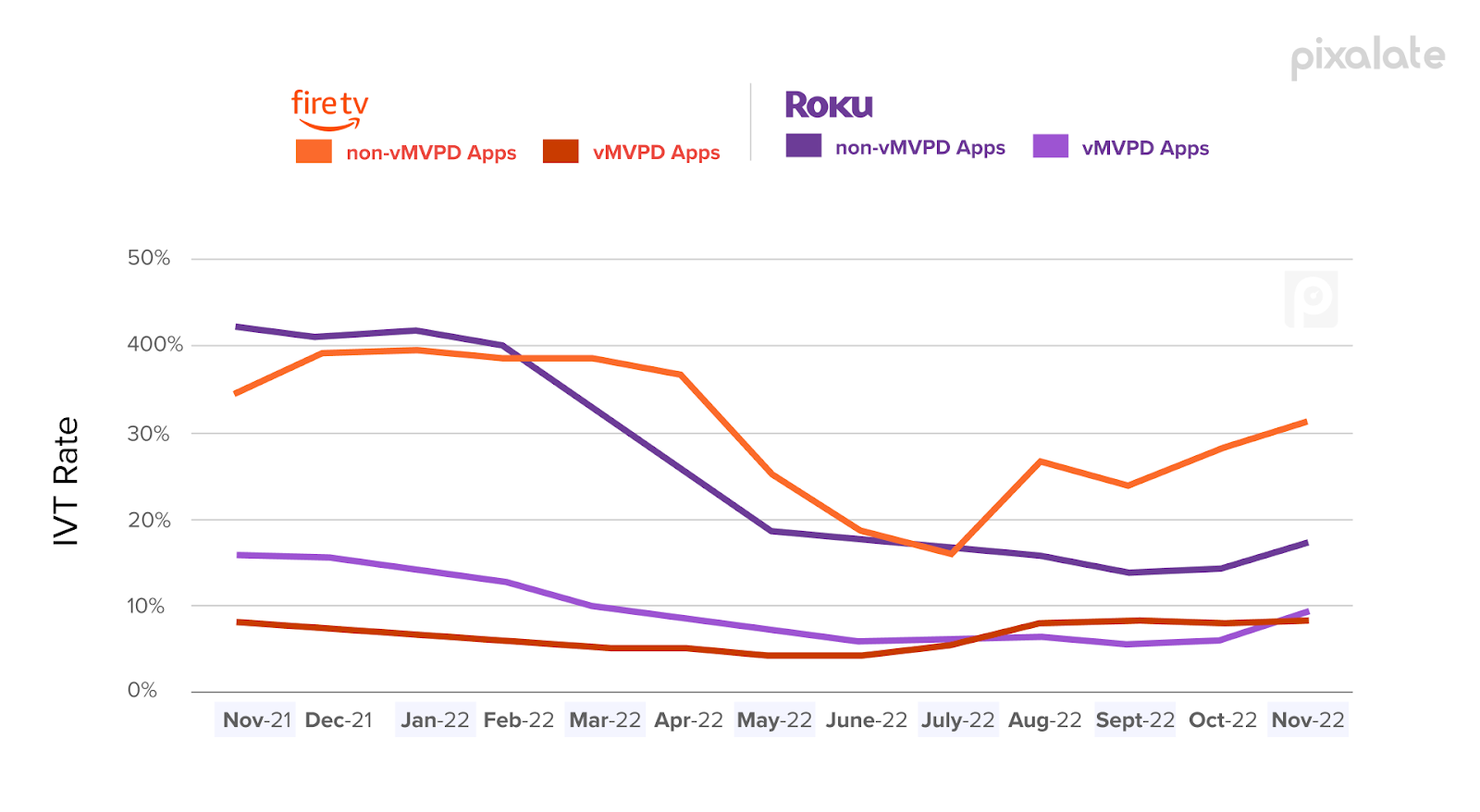

3. Invalid Traffic (IVT)

Pixalate measured an IVT rate of 10.7% on popular vMVPD apps during November 2022, compared to 15.4% across non-vMVPD apps in the CTV ecosystem.

This is further broken down by app store as follows:

- Roku: 11.4% IVT for vMVPD apps vs 14.9% IVT for non-vMVPD

- Amazon Fire TV: 8.2% IVT for vMVPD apps vs 25.7% IVT for non-vMVPD

And tracking change in IVT Rates over time as follows:

Top vMPVD apps:

Roku

- Pluto TV

- Tubi

- Sling TV

- Philo

- fuboTV

Amazon Fire TV

- Hulu

- Pluto TV

- Tubi

- Sling TV

- FuboTV

Download the full list of Pixalate’s top 50 most popular vMVPD apps on Amazon Fire TV and Roku for free today.

If you are interested in more insights like these from Pixalate, across desktop, mobile and CTV devices, please reach out to us using this contact form.

Disclaimer

The content of this press release, and the vMVPD Traffic Overview Report (the “Report”), reflect Pixalate's opinions with respect to factors that Pixalate believes may be useful to the digital media industry. Pixalate’s opinions are just that, opinions, which means that they are neither facts nor guarantees; and neither this press release nor the Report are intended to impugn the standing or reputation of any entity, person or app, but instead, to report findings and apparent trends pertaining to CTV apps from the Roku and Amazon Fire TV app stores. Pixalate's datasets — which are used exclusively to derive these insights — consist predominantly of buy-side open auction programmatic traffic sources.