Pixalate’s January 2023 CTV FAST Apps Report explores the ad traffic characteristics of Free Ad-Supported TV (FAST) apps and surfaces interesting programmatic ad insights across Roku and Amazon Fire TV apps.

Key takeaways:

- In January 2023, FAST apps accounted for 43 of the top 100 apps ranked by impression volume on Amazon Fire TV and 24 of top 100 apps on Roku were found to be FAST apps.

- Pluto, Tubi and Sling land on both Roku and Fire TV lists for January 2023.

- Invalid Traffic (IVT) rates on FAST apps appear to be lower compared to non-FAST apps on Roku at 10% vs 16%. IVT levels were relatively the same for both FAST and non-FAST apps at ~8% on Fire TV.

What are FAST Apps?

FAST (Free Ad-Supported TV) is a form of content delivery where the viewer is able to access “linear” content without paying for a subscription. “Linear” means that the content is presented in the form of channels, and the same content is streamed to all users of a given channel at a given time. Instead of the viewers paying for a subscription, this content is supported by ad revenue.

Why are FAST Apps important?

In recent years, the trend of “cutting the cord” has resulted in a proliferation of streaming services. This has led to the sentiment that signing up to streaming services is starting to get as expensive as cable bundles used to be. FAST apps appear to be thriving in response to this sentiment, providing users with free (but ad-supported) video streaming services.

Consumer adoption of FAST apps accelerated during the height of the COVID pandemic, and they are now widely available with significant user bases, making FAST apps attractive to advertisers.

Pixalate’s definition and methodology to identify FAST apps

We have seen a number of different definitions of FAST apps from various sources. For the purposes of this report, we made some distinctions that we believe will help our understanding of FAST apps:

- Any app that has a FAST option (linear, free, ad supported) is a FAST app - even if it has other forms of delivery (like Video on Demand, or VOD) or price tiering (paid options in addition to the free option);

- Not all Advertising-Based Video on Demand (AVOD) apps are FAST apps - since they may not be linear, or they may not have free tiers;

- vMPVD (virtual Multichannel Video Programming Distributor) apps are not automatically considered FAST apps. They are only included if they have a fully free option (like Sling TV); and

- The linear requirement eliminates apps like Netflix and Crackle since they are on demand only.

Additionally, it’s important to note that FAST channels and apps are separate concepts. There are 1,400+ FAST channels, according to various reports, but a much smaller number of FAST apps hosting said channels for the viewer to download and use. This is especially confusing on Roku, where FAST channels and apps are grouped together in search results. We don’t consider the Roku FAST channels individually, since they all appear to fall under the Roku app.

A quick breakdown of FAST Apps by the numbers

Pixalate measured open programmatic impressions on the top Roku and Amazon Fire TV FAST apps (defined by the methodology above) in January 2023 and found:

- Impression Volume and Ad Spend

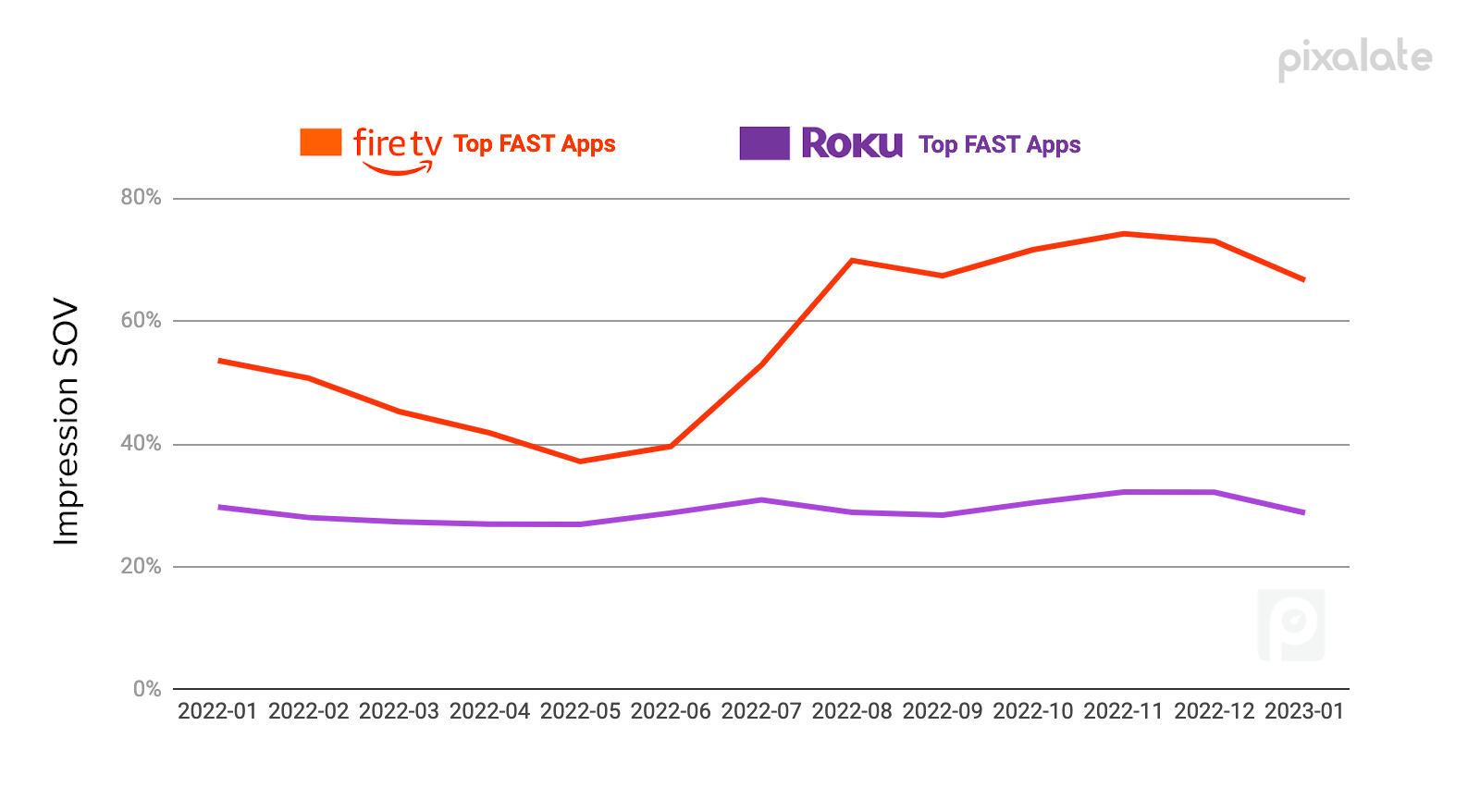

Pixalate estimates that in January 2023, 65% of open programmatic ad impression volume on the Fire TV platform, and 27% on Roku, went to FAST apps.

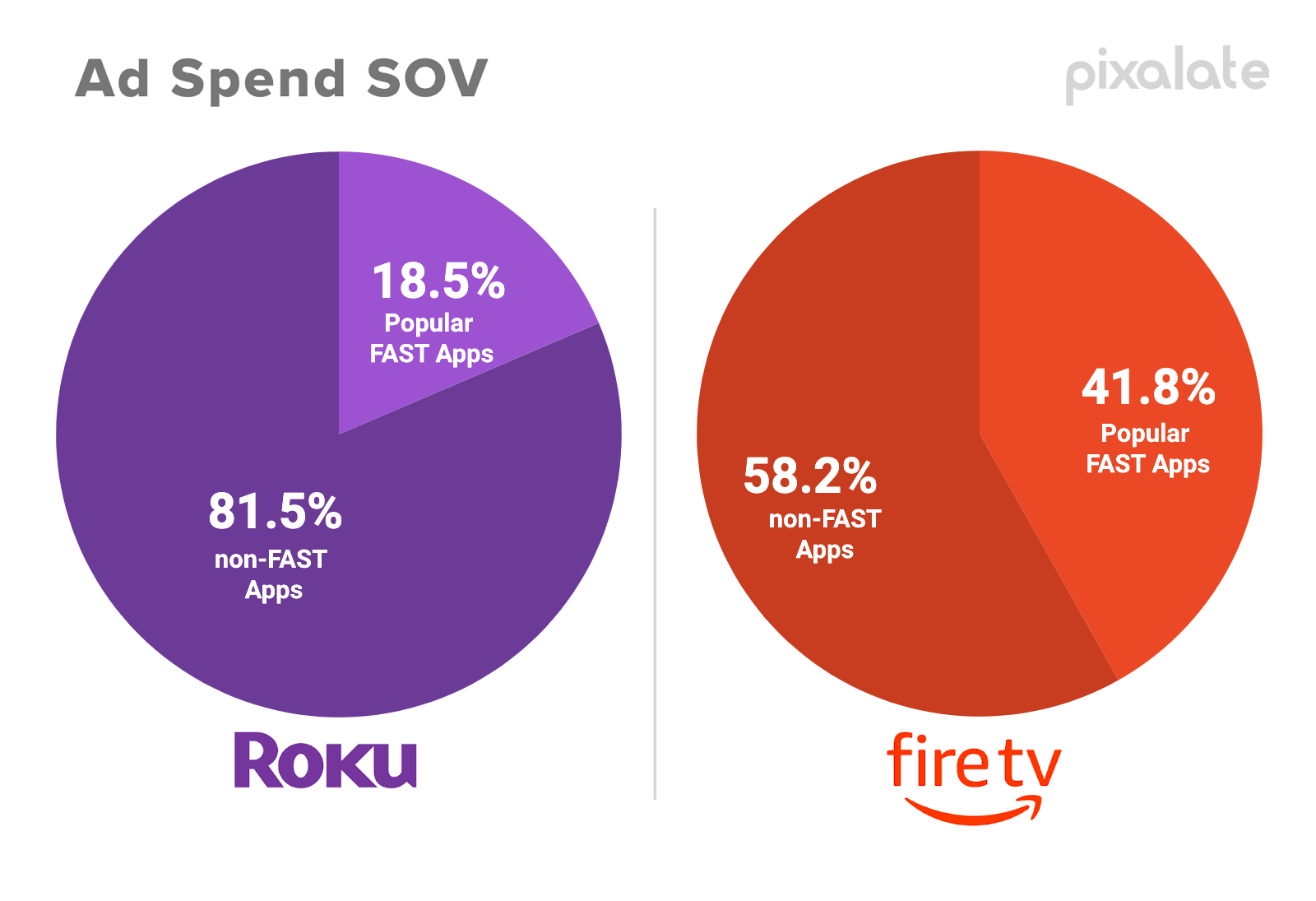

Similarly, Pixalate estimates that 42% of open programmatic ad spend on the Fire TV platform, and 18% on Roku, go to FAST apps.

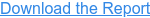

IVT on FAST apps on Roku appeared to have lower IVT at 10.6%, compared to 16.6% for non-FAST apps during January 2023. On FireTV the rates on both FAST and non-FAST apps appeared to be similar, at around 8%.

Top FAST apps with open programmatic advertising, January 2023:

Roku

- Pluto TV

- Sling TV*

- Tubi - Free Movies & TV

- Bloomberg

- Xumo

Amazon Fire TV

- Pluto TV - It's Free TV

- Tubi - Watch Free Movies & TV Shows

- Sling TV*

- Plex

- Local Now Plus - Free News, Weather

*Sling TV traffic volume included their non-FAST channels for the purpose of this report.

Our list of top 15 FAST apps on Roku and Fire TV can be found in the downloadable report linked below. The download includes:

- App name and ranking based on open programmatic ad transactions in January 2023;

- App ID (static and unique to each store);

- Common bundle IDs (used in open programmatic ad requests to reference the app, but sometimes there’s more than one); and

- Link to the app in Pixalate’s MRT which contains more details about the app, including additional common bundle IDs, IVT information, and more.

About Pixalate

Pixalate is the market-leading fraud protection, privacy, and compliance analytics platform for Connected TV (CTV) and Mobile Advertising. We work 24/7 to guard your reputation and grow your media value. Pixalate offers the only system of coordinated solutions across display, app, video, and CTV for better detection and elimination of ad fraud. Pixalate is an MRC-accredited service for the detection and filtration of sophisticated invalid traffic (SIVT) across desktop and mobile web, mobile in-app, and CTV advertising. www.pixalate.com

Disclaimer

The content of this press release, and the January 2023 CTV FAST Apps Report (the “Report”), reflect Pixalate's opinions with respect to factors that Pixalate believes may be useful to the digital media industry. Pixalate’s opinions are just that, opinions, which means that they are neither facts nor guarantees; and neither this press release nor the Report are intended to impugn the standing or reputation of any entity, person or app, but instead, to report findings and apparent trends pertaining to CTV apps from the Roku and Amazon Fire TV app stores. Pixalate's datasets — which are used exclusively to derive these insights — consist predominantly of buy-side open auction programmatic traffic sources.