In Pixalate's latest special report, Programmatic Ad Spend in the Age of COVID-19: Connected TV/OTT Advertising, we examine how OTT/CTV advertisers have adjusted ad spend in the face of a global crisis.

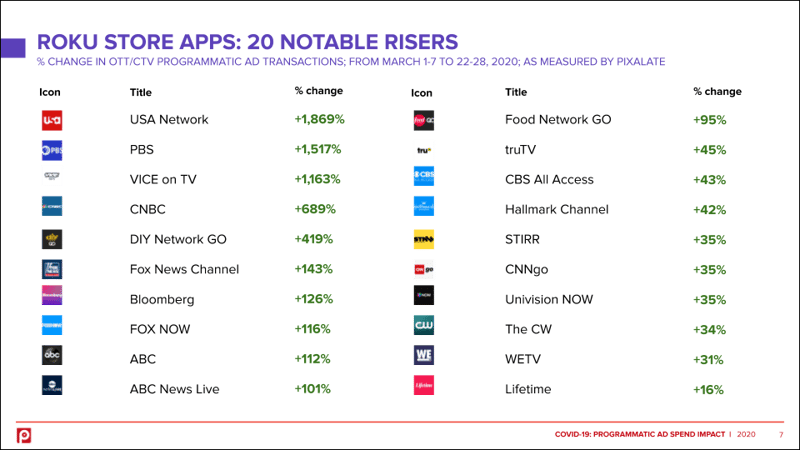

While overall programmatic OTT/CTV ad spend decreased 14% in March, certain apps saw big jumps in demand.

Note: Pixalate is using programmatic ad transactions as a proxy for ad spend for this research.

Roku apps that gained the most: PBS sees a 1,517% increase in ad spend

PBS, the Public Broadcasting Service featuring music, the arts, and news analysis, saw a 1,517% increase in programmatic ad spend, comparing the first full week of March (March 1-7) to the last full week (March 22-28).

Other notable risers:

- PBS (+1,517%)

- CNBC (+689%)

- DIY Network GO (+419%)

- Fox News Channel (+143%)

- ABC (+112%)

See the chart above to see 20 notable risers.

What's inside the report

Pixalate's Programmatic Ad Spend in the Age of COVID-19: Connected TV/OTT Advertising report includes:

- Programmatic OTT/CTV ad spend trends on a week-by-week basis in March 2020

- Fastest-rising Roku apps based on ad spend

- Roku apps that lost the most ad spend

- OTT/CTV device types that saw the biggest change in ad spend and ad market share of voice

- Roku app categories that saw the most change based on ad spend

- Supply-side platforms (SSPs) that saw the most change in programmatic ad share of voice

Download a free copy of the Programmatic Ad Spend in the Age of COVID-19: Connected TV/OTT Advertising report today.

Disclaimer

The content of this blog, and the Programmatic Ad Spend in the Age of COVID-19: Connected TV/OTT Advertising report (the "Report"), reflect Pixalate's opinions with respect to the factors that Pixalate believes can be useful to the digital media industry. Any proprietary data shared is grounded in Pixalate's proprietary technology and analytics, which Pixalate is continuously evaluating and updating. As cited in the Report and referenced in the Report's key findings reproduced herein, programmatic ad transactions, as measured by Pixalate, are used as a proxy for ad spend. The Report examines U.S. advertising activity. Any references to outside sources in the Report and herein should not be construed as endorsements. Pixalate's opinions are just that, opinions, which means that they are neither facts nor guarantees.

%20Mobile%20Apps%20Benchmarks%20Report%20-%20Q3%202025%20-%20GLOBAL.png)